Understanding the Symbolic Representation of Financial Products

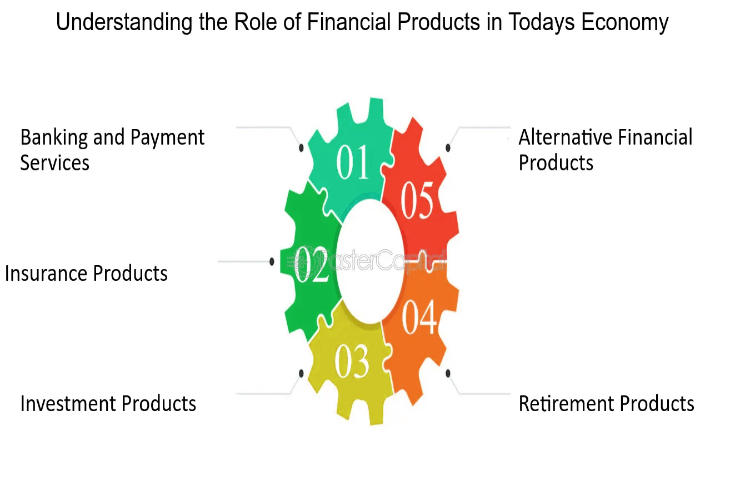

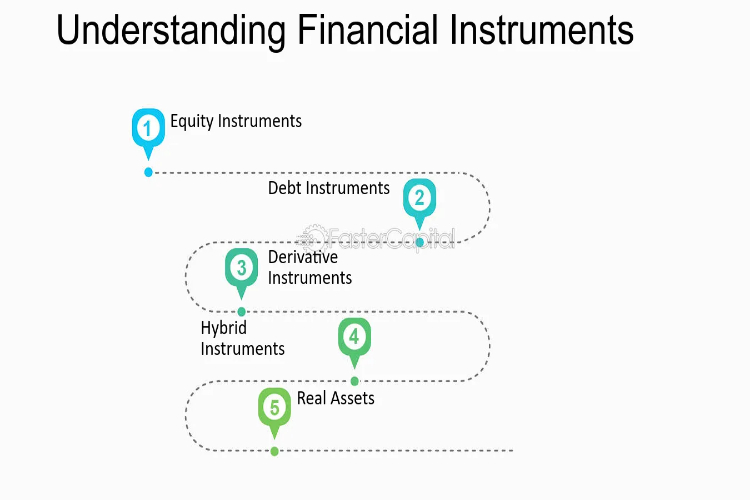

In the complex system of the financial world, where myriad products vie for attention, understanding their symbolic representation is akin to making out a complex language. Each financial product, whether stocks, bonds, derivatives, or mutual funds, embodies a unique set of symbols that encapsulate its essence, risk profile, and potential rewards. This symbolic representation serves […]

Understanding the Symbolic Representation of Financial Products Read More »