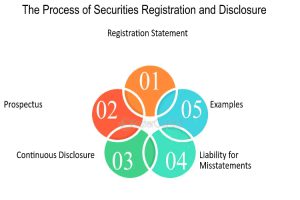

The securities registration process is a vital mechanism in financial markets, serving to uphold compliance and transparency standards. As a fundamental component of regulatory frameworks worldwide, it mandates that securities issuers disclose essential information to investors and regulatory bodies before offering their securities for public sale. This process involves meticulous documentation and scrutiny to ensure that pertinent details regarding the issuing entity, its financial health, operations, and risks associated with the securities are transparently communicated.

The securities registration process is a vital mechanism in financial markets, serving to uphold compliance and transparency standards. As a fundamental component of regulatory frameworks worldwide, it mandates that securities issuers disclose essential information to investors and regulatory bodies before offering their securities for public sale. This process involves meticulous documentation and scrutiny to ensure that pertinent details regarding the issuing entity, its financial health, operations, and risks associated with the securities are transparently communicated.

By requiring issuers to register their securities, regulators aim to protect investors from fraudulent schemes and misinformation while fostering confidence in the integrity of the financial system. Additionally, registration facilitates market efficiency by providing investors with access to comprehensive and reliable information, enabling informed decision-making. Through periodic reporting obligations, registered entities are held accountable for disclosing material changes in their operations or financial condition, further bolstering transparency and investor protection.

Moreover, the Securities registration process process serves as a gatekeeper for market entry, allowing regulators to assess the suitability of securities offerings and the competency of issuers. This scrutiny helps maintain market stability and integrity, safeguarding against systemic risks and preserving investor trust. Ultimately, by enforcing compliance and transparency standards, the securities registration process plays a crucial role in promoting fair and orderly capital markets that benefit both investors and issuers alike.

Importance of Compliance in Securities Registration

- Compliance with securities registration process requirements is imperative for both issuers and investors, as it ensures adherence to regulatory standards and promotes market integrity. One of the primary objectives of compliance is to safeguard investors’ interests by providing them with accurate and reliable information essential for making informed investment decisions. By adhering to registration procedures, issuers demonstrate their commitment to transparency and accountability, fostering trust among investors and stakeholders.

- Furthermore, compliance with securities registration regulations helps mitigate risks associated with fraudulent activities and securities violations. By subjecting issuers to thorough scrutiny and disclosure obligations, regulatory authorities can identify potential irregularities or inconsistencies in financial reporting, thereby deterring deceptive practices and enhancing market confidence. Compliance also acts as a deterrent to unethical behavior, as non-compliance can result in severe penalties, including fines, sanctions, and legal repercussions.

- Moreover, the registration process promotes market efficiency by facilitating fair and equal access to information for all market participants. By standardizing disclosure requirements and mandating public dissemination of relevant information, registration enhances price discovery and reduces information asymmetry, leading to more efficient capital allocation. This transparency fosters a level playing field, enabling investors to assess the risks and rewards associated with various investment opportunities accurately.

- Additionally, compliance with securities registration regulations is essential for maintaining regulatory oversight and supervision of capital markets. Regulatory authorities rely on registration data and reporting requirements to monitor market activities, detect potential violations, and enforce regulatory compliance effectively. Through ongoing oversight and surveillance, regulators can detect and address emerging risks or systemic vulnerabilities, thereby preserving market stability and investor confidence.

- Furthermore, compliance with securities registration process requirements is essential for accessing capital markets and attracting investment capital. Registered securities are typically perceived as safer and more trustworthy investment options, as they have undergone regulatory scrutiny and disclosure obligations. Consequently, compliance enhances the marketability and liquidity of securities, making them more attractive to a broader investor base.

- In conclusion, compliance with securities registration regulations is critical for ensuring investor protection, promoting market integrity, and fostering efficient capital markets. By adhering to registration requirements, issuers demonstrate their commitment to transparency and accountability while providing investors with essential information for making informed investment decisions. Additionally, compliance supports regulatory oversight and supervision, mitigates risks associated with fraudulent activities, and enhances market efficiency and liquidity. Overall, a robust culture of compliance is essential for maintaining the integrity and resilience of global capital markets.

Maintaining the integrity and resilience of global capital markets

Maintaining the integrity and resilience of global capital markets is a multifaceted endeavor that requires collaboration among regulators, market participants, and other stakeholders. Several key factors contribute to achieving this goal, including effective regulation, market transparency, risk management practices, and investor education.

Effective regulation is paramount in ensuring the integrity of capital markets. Regulators establish and enforce rules and standards that govern market activities, including securities registration, trading practices, and disclosure requirements. By enforcing compliance with these regulations, regulators deter fraudulent activities, promote fair competition, and protect investors from market abuses.

Market transparency is another critical aspect of maintaining market integrity. Transparency ensures that relevant information about securities, market participants, and trading activities is readily available to investors. Transparent markets facilitate price discovery, reduce information asymmetry, and enhance investor confidence. Regulatory initiatives such as mandatory reporting, disclosure requirements, and transparency mechanisms contribute to market transparency.

Robust risk management practices are essential for mitigating systemic risks and preserving market resilience. Market participants, including financial institutions, investment firms, and trading venues, employ risk management frameworks to identify, assess, and mitigate various types of risks, including credit risk, market risk, liquidity risk, and operational risk. Effective risk management practices help prevent market disruptions, limit contagion effects, and enhance overall market stability.

Investor education plays a crucial role in fostering informed decision-making and protecting investors from financial harm. Educated investors are better equipped to understand market dynamics, evaluate investment risks, and recognize fraudulent schemes. Regulatory authorities, financial institutions, and industry associations often collaborate to provide investor education programs, resources, and tools to promote financial literacy and empower investors to make sound investment choices.

Furthermore, technological innovation and advancements in market infrastructure contribute to the integrity and resilience of global capital markets. Modern trading platforms, electronic trading systems, and risk management tools enhance market efficiency, transparency, and resilience. However, regulators must adapt to technological advancements and address emerging challenges, such as cybersecurity threats and algorithmic trading risks, to maintain market integrity in an increasingly digitized environment.

Conclusion

Maintaining the integrity and resilience of global capital markets requires a comprehensive approach encompassing effective Securities registration process, market transparency, risk management practices, investor education, and technological innovation. By addressing these key factors, regulators and market participants can uphold market integrity, promote investor confidence, and ensure the continued stability and resilience of global capital markets.

Disclaimer: “This article is for educational & entertainment purposes.”