In the bustling world of financial markets, where transactions happen in fractions of a second and information travels at the speed of light, few elements stand as ubiquitous and yet as enigmatic as the ticker symbol. These seemingly innocuous strings of letters, often appearing alongside company names, hold immense significance in the realm of investment and trading. Behind each ticker symbol lies a story, a history, and a wealth of information waiting to be deciphered by those fluent in the language of finance.

In the bustling world of financial markets, where transactions happen in fractions of a second and information travels at the speed of light, few elements stand as ubiquitous and yet as enigmatic as the ticker symbol. These seemingly innocuous strings of letters, often appearing alongside company names, hold immense significance in the realm of investment and trading. Behind each ticker symbol lies a story, a history, and a wealth of information waiting to be deciphered by those fluent in the language of finance.

Ticker symbol assignment, the process by which these symbols are allocated to companies, plays a pivotal role in the functioning of global markets. Far more than just a convenient shorthand for identifying stocks, ticker symbols serve as a fundamental tool for investors, analysts, and traders alike. They encapsulate a company’s identity, providing a concise representation of its brand, industry, and standing in the market hierarchy.

Moreover, ticker symbols are the currency of communication in financial markets. They facilitate the rapid dissemination of information, enabling stakeholders to track price movements, analyze trends, and execute trades with precision. In essence, they are the building blocks upon which the edifice of modern finance is constructed.

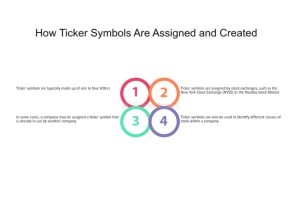

Yet, the assignment of ticker symbols is not a haphazard process; rather, it is governed by a set of rules and conventions established by regulatory bodies and market authorities. Understanding these rules is essential for grasping the intricacies of symbol allocation and for interpreting the wealth of data encoded within each ticker.

Here, we are going to explore the significance of ticker symbol assignment, exploring its impact on market dynamics, investor behavior, and the broader financial ecosystem. Through a comprehensive examination of its history, mechanics, and implications, we aim to shed light on this often-overlooked aspect of the investment landscape.

The Evolution of Ticker Symbol Assignment

Historical Origins:

Ticker symbols trace their roots back to the early days of stock trading, when transactions were recorded manually on ticker tape machines. Initially, symbols were simple abbreviations chosen for ease of use and clarity among traders.

Standardization Efforts:

As financial markets expanded and became more complex, the need for standardized ticker symbols grew. Regulatory bodies and exchanges began implementing guidelines to ensure consistency and prevent confusion among market participants.

Modernization and Technology:

With the advent of electronic trading platforms and computerized systems, the process of assigning ticker symbols underwent a significant transformation. Automated algorithms now play a key role in generating symbols, considering factors such as company name, industry, and market sector.

The Mechanics of Ticker Symbol Allocation

Regulatory Framework:

Ticker symbol assignment is subject to regulatory oversight by entities such as the Securities and Exchange Commission (SEC) in the United States and equivalent agencies in other jurisdictions. These regulatory bodies establish guidelines to govern the assignment process and ensure compliance with securities laws.

Exchange Rules and Listings:

Exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ, have their own rules and procedures for assigning ticker symbols to listed companies. These rules may vary depending on factors such as market capitalization, trading volume, and corporate structure.

Corporate Actions and Changes:

Ticker symbols can change as a result of corporate actions such as mergers, acquisitions, spin-offs, or rebranding efforts. In such cases, exchanges and regulatory authorities oversee the transition process to ensure continuity and transparency for investors.

Global Considerations:

In today’s interconnected world, companies often trade on multiple exchanges across different countries and regions. Coordinating ticker symbol assignment across global markets requires collaboration among exchanges and regulatory authorities to maintain consistency and facilitate cross-border trading.

Impact on Market Dynamics

The assignment of ticker symbols directly influences market dynamics by shaping investor perceptions, market sentiment, and trading behavior. A well-chosen ticker symbol can convey a sense of stability, innovation, or growth potential, thereby influencing investor sentiment and attracting interest from traders. Conversely, a poorly selected symbol may raise doubts about a company’s credibility or market positioning, potentially dampening investor enthusiasm and affecting stock performance.

Moreover, changes in ticker symbols can signal significant events or developments within a company, such as a shift in corporate strategy, a rebranding effort, or a merger/acquisition. These changes can have ripple effects across the market, leading to fluctuations in trading volume, volatility, and price movements. By closely monitoring ticker symbol assignments and associated corporate actions, investors and analysts can gain valuable insights into market trends and identify potential opportunities or risks.

Investor Considerations and Strategies

For investors, understanding the nuances of ticker symbol assignment can be crucial in formulating investment strategies and managing portfolios effectively. Ticker symbols serve as shorthand for identifying stocks within a vast universe of investment opportunities, allowing investors to quickly assess potential candidates for inclusion in their portfolios. Moreover, investors may employ strategies based on ticker symbols, such as sector rotation or thematic investing, to capitalize on emerging trends or economic themes.

Furthermore, changes in ticker symbols can prompt investors to reassess their investment thesis or conduct additional due diligence on a company. For example, a company undergoing a ticker symbol change due to a merger may prompt investors to evaluate the potential synergies, integration challenges, and financial implications of the transaction. By staying informed about ticker symbol assignments and their implications, investors can make more informed decisions and navigate market developments with greater confidence.

Conclusion:

In the intricate tapestry of financial markets, ticker symbol assignment emerges as a vital thread, weaving together companies, investors, and regulators in a symbiotic relationship. From its humble origins on ticker tape machines to its modern manifestation in electronic trading platforms, the allocation of ticker symbols has evolved into a cornerstone of market infrastructure, shaping investor perceptions, market dynamics, and regulatory oversight.

The significance of ticker symbol assignment extends beyond mere identification; it serves as a conduit for communication, facilitating the flow of information and capital across global markets. Each ticker symbol encapsulates a company’s essence, embodying its brand, industry, and market positioning in a concise alphanumeric code. Moreover, changes in ticker symbols serve as signposts for significant corporate events, reflecting shifts in strategy, ownership, or market status.

As we navigate the ever-changing landscape of finance, the significance of ticker symbol assignment remains steadfast, underpinning the integrity, transparency, and efficiency of global markets. By recognizing its importance and embracing its implications, we can harness the power of ticker symbols to drive innovation, foster trust, and unlock new opportunities for prosperity in the dynamic world of finance.

Disclaimer: “This article is for educational & entertainment purposes.”