Importance of CUSIP in Mortgage loan Securitization Documentation

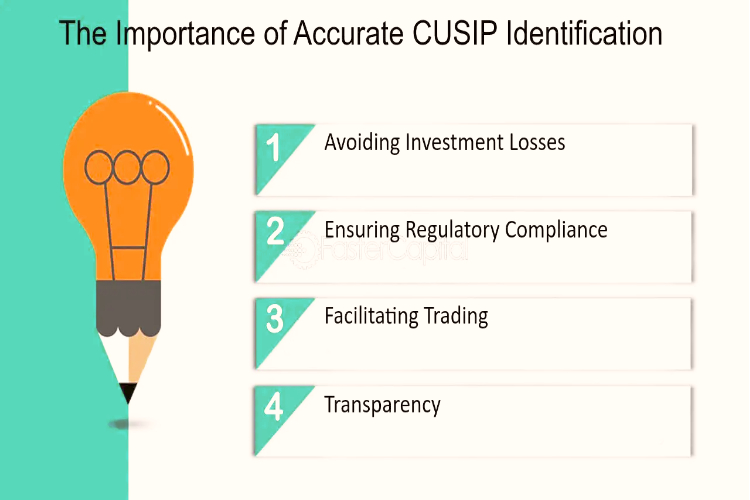

In the intricate world of mortgage loan securitization, where bundles of loans are packaged and sold as securities to investors, the presence of a unique identifier plays a pivotal role in ensuring transparency, efficiency, and risk management. This identifier, known as the CUSIP (Committee on Uniform Securities Identification Procedures) number, serves as a vital component […]

Importance of CUSIP in Mortgage loan Securitization Documentation Read More »