Securitizing Mortgages: Enhancing Liquidity and Stability in Financial Markets

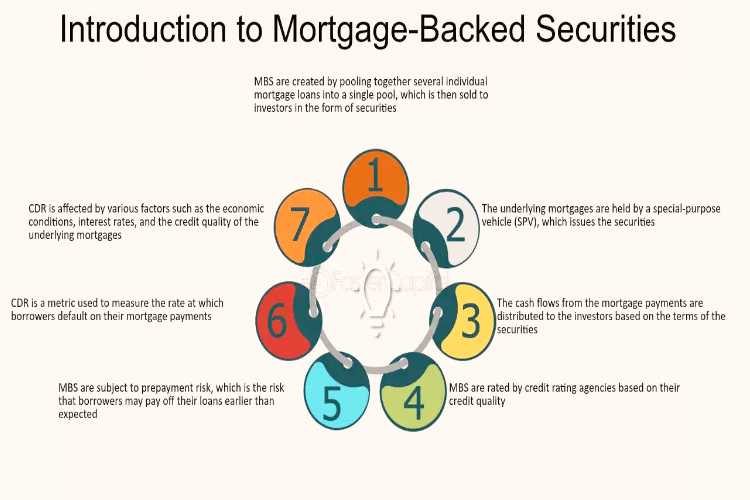

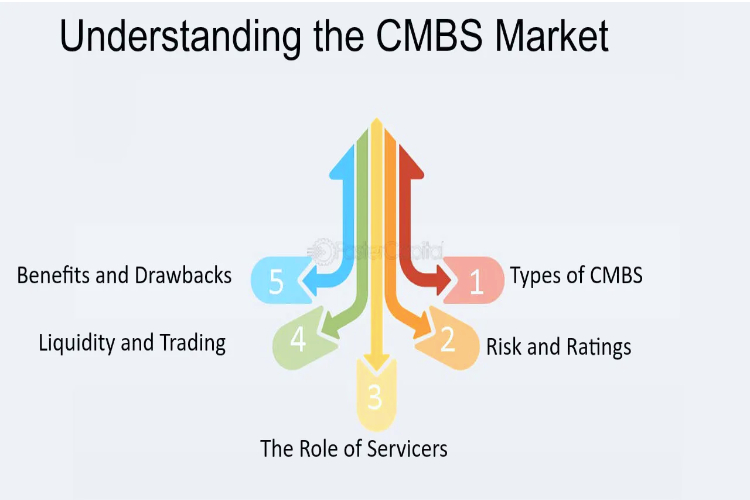

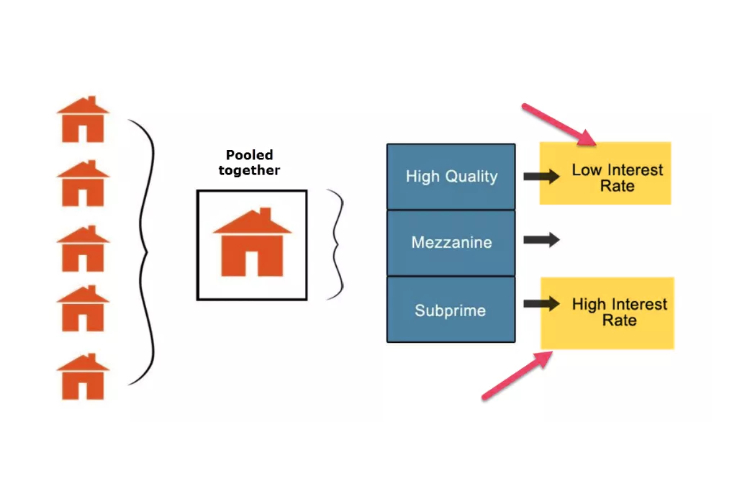

The securitization of mortgage loans has emerged as a pivotal mechanism within financial markets, playing a crucial role in enhancing liquidity and stability. This process involves transforming individual mortgage loans into tradable securities, thereby enabling financial institutions to diversify risk and investors to access a broader range of investment opportunities. In recent decades, the securitization […]

Securitizing Mortgages: Enhancing Liquidity and Stability in Financial Markets Read More »