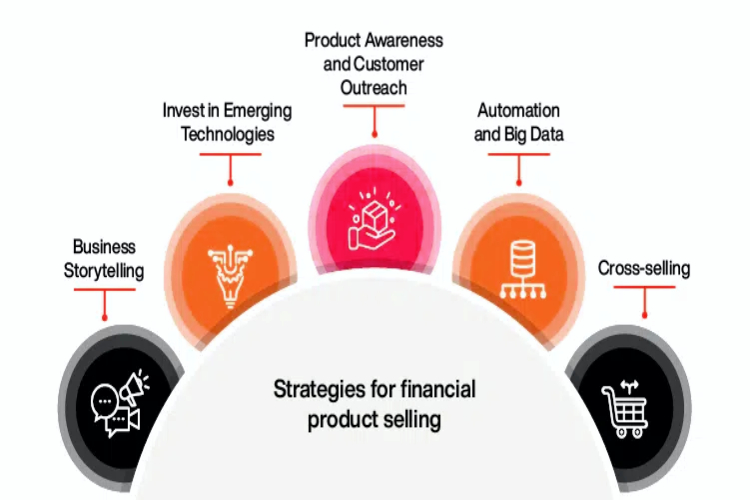

Strategies for Effective Financial Instrument Master Data Governance

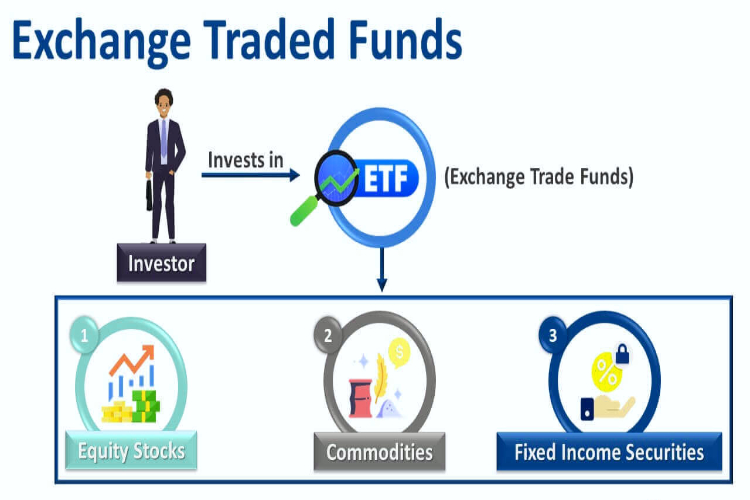

In the sector of modern finance, where intricate networks of transactions shape global markets, the management and governance of financial instrument master data stand as foundational pillars of stability and success. The complexities inherent in financial instruments, ranging from stocks and bonds to derivatives and commodities, demand meticulous attention to detail and robust governance frameworks […]

Strategies for Effective Financial Instrument Master Data Governance Read More »