Exchange-Traded Security Identifiers for Unveiling the financial Anatomy

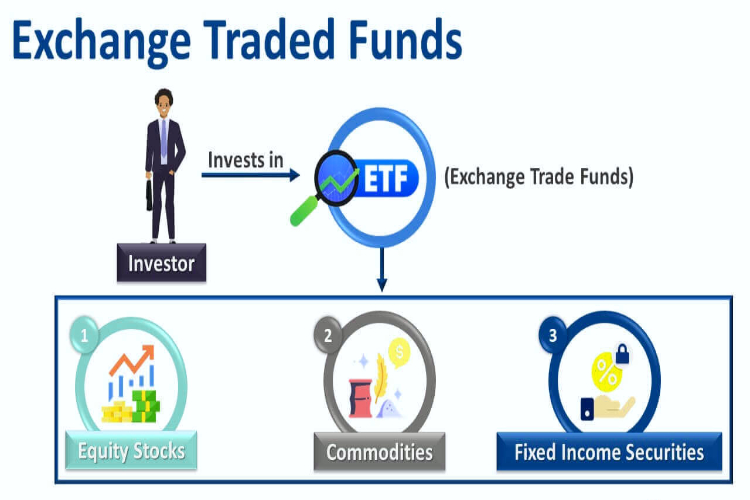

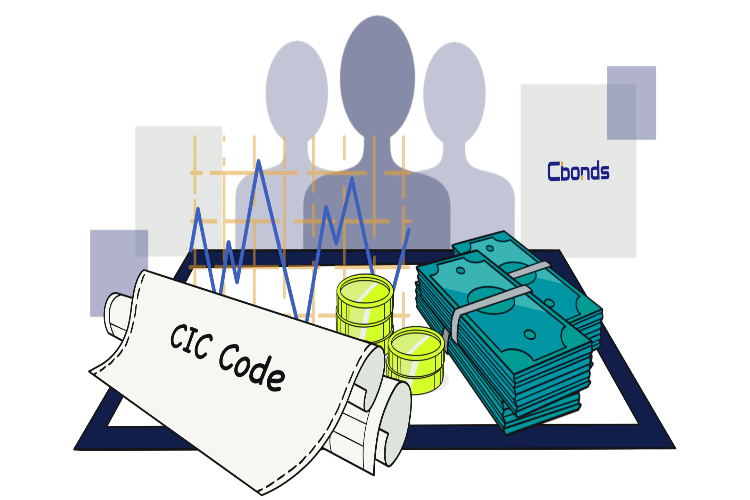

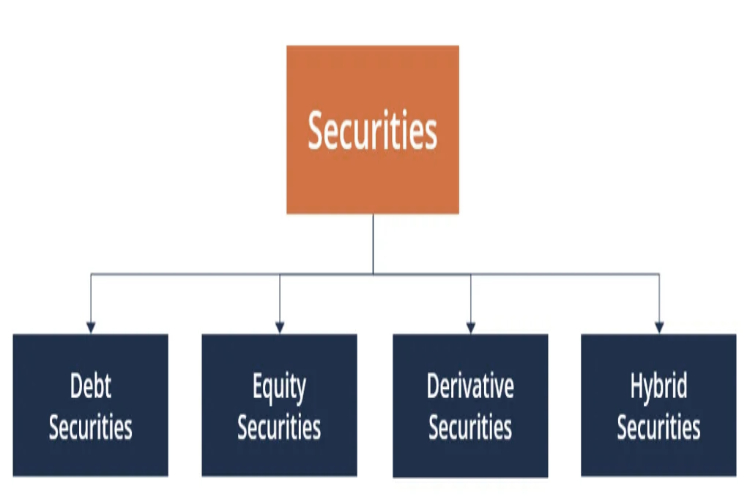

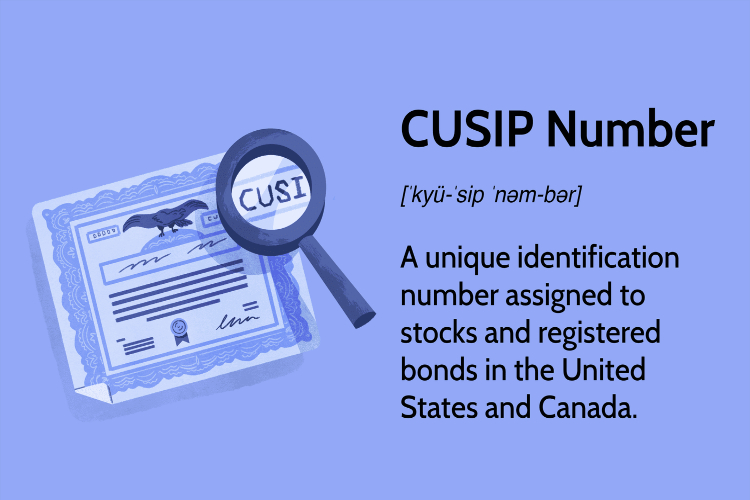

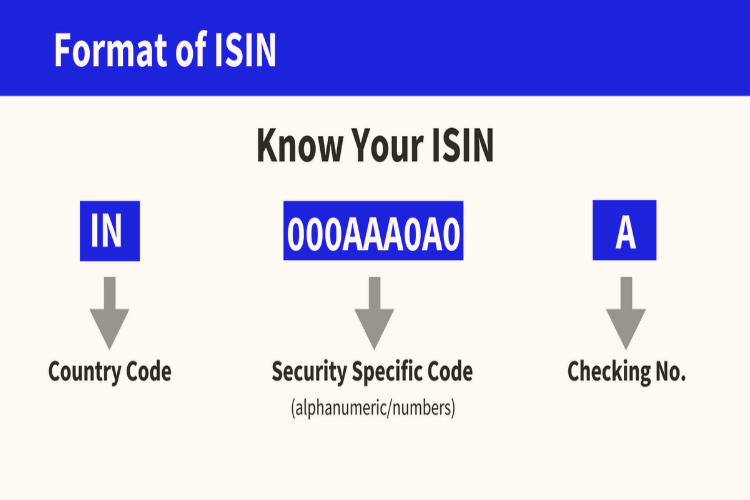

Exchange-Traded Security Identifiers (ETSI) serve as the cornerstone for unraveling the intricate financial anatomy of modern markets. In a world where investment opportunities abound and financial instruments proliferate, the ability to accurately identify, track, and analyze these securities is paramount. ETSIs provide a standardized framework for uniquely identifying each traded security, enabling efficient market operations, […]

Exchange-Traded Security Identifiers for Unveiling the financial Anatomy Read More »