This article is an intricate journey of mortgage loan securitization, a cornerstone of contemporary financial markets. Over the years, this financial instrument has transformed the landscape of lending and investing, profoundly impacting both the housing market and the global economy. As we navigate through the complexities of mortgage loan securitization, it becomes evident that its evolution is deeply intertwined with the management and perception of risk.

This article is an intricate journey of mortgage loan securitization, a cornerstone of contemporary financial markets. Over the years, this financial instrument has transformed the landscape of lending and investing, profoundly impacting both the housing market and the global economy. As we navigate through the complexities of mortgage loan securitization, it becomes evident that its evolution is deeply intertwined with the management and perception of risk.

In the aftermath of the financial crises that have shaped modern finance, the scrutiny and understanding of risk have become paramount. Mortgage loan securitization once hailed as a groundbreaking innovation, found itself at the center of debates surrounding risk management practices. This article aims to trace the trajectory of this financial practice, examining its origins, development, and implications for contemporary finance.

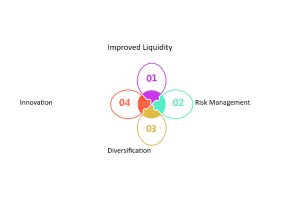

At its core, mortgage loan securitization involves the bundling of individual mortgages into securities that are then sold to investors. This process enables lenders to mitigate risk by diversifying their exposure and provides investors with opportunities for stable returns. However, the evolution of mortgage loan securitization has been marked by periods of innovation, regulatory intervention, and crisis.

From the pioneering efforts of government-sponsored entities like Fannie Mae and Freddie Mac to the proliferation of mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), the landscape of mortgage loan securitization has undergone significant transformation. Alongside these developments, perceptions of risk have evolved, leading to a reassessment of practices and regulations governing this complex financial instrument.

As we investigate deeper into the evolution of mortgage loan securitization, it becomes evident that understanding its intricacies is essential for navigating the complexities of modern finance and managing risk effectively. Through this exploration, we aim to shed light on the past, present, and future of this critical aspect of the financial system.

-

Origins and Development of Mortgage Loan Securitization

Government-Sponsored Enterprises (GSEs) and Early Initiatives:

- Explore the role of entities like Fannie Mae and Freddie Mac in pioneering the concept of mortgage-backed securities (MBS).

- Discuss the objectives behind the creation of these government-sponsored enterprises and their impact on the housing market.

Emergence of Private Securitization:

- Trace the transition from predominantly government-backed initiatives to the rise of private securitization.

- Examine the factors driving the growth of private-label mortgage-backed securities (PMBS) and their implications for risk management.

Innovation and Complexity:

- Investigate the innovations in mortgage loan securitization, such as the creation of collateralized mortgage obligations (CMOs) and structured finance products.

- Analyze the increasing complexity of mortgage-backed securities and the challenges posed to investors and regulators.

-

Regulatory Responses and Crisis Management

Regulatory Frameworks and Oversight:

- Explore the regulatory responses to the expansion of mortgage loan securitization, including the role of agencies like the Securities and Exchange Commission (SEC) and the Federal Housing Finance Agency (FHFA).

- Assess the effectiveness of regulatory measures in ensuring transparency and stability within the mortgage-backed securities market.

Impact of Financial Crises:

- Examine the role of mortgage loan securitization in the subprime mortgage crisis of 2008 and subsequent financial downturns.

- Discuss the lessons learned from past crises and their implications for risk management practices and regulatory reforms.

Trends and Challenges in Contemporary Finance:

- Analyze the current landscape of mortgage loan securitization, including trends in issuance volumes, investor preferences, and regulatory developments.

- Identify emerging challenges and opportunities in the mortgage-backed securities market, such as the integration of environmental, social, and governance (ESG) factors and the potential for technological disruption.

-

Risk Assessment and Management in Mortgage Loan Securitization

Quantifying and Mitigating Risk:

- Explore the methodologies used to assess and manage risk in mortgage loan securitization, including credit risk, interest rate risk, and prepayment risk.

- Discuss the role of credit enhancement mechanisms, such as over-collateralization and credit derivatives, in enhancing the creditworthiness of mortgage-backed securities.

Challenges in Risk Modeling:

- Analyze the challenges inherent in modeling risk within the mortgage-backed securities market, including data limitations, model complexity, and the dynamic nature of underlying assets.

- Examine the implications of inaccurate risk assessments and the potential for systemic risk in the event of market disruptions or economic downturns.

-

Investor Perspectives and Market Dynamics

Investor Preferences and Risk Appetite:

- Explore the factors influencing investor preferences in the mortgage-backed securities market, including yield considerations, risk tolerance, and market sentiment.

- Discuss the impact of regulatory changes, market conditions, and macroeconomic factors on investor behavior and asset allocation decisions.

Market Liquidity and Price Discovery:

- Analyze the liquidity dynamics of mortgage-backed securities and their implications for price discovery and market efficiency.

- Examine the role of market participants, including institutional investors, dealers, and market makers, in facilitating trading activity and enhancing market liquidity.

-

Future Trends and Innovations in Mortgage Loan Securitization

Technology and Digitization:

- Explore the potential impact of technology and digitization on mortgage loan securitization, including blockchain-based platforms, smart contracts, and artificial intelligence.

- Discuss the opportunities for streamlining processes, reducing costs, and enhancing transparency within the mortgage-backed securities market.

Sustainable Finance and ESG Integration:

- Analyze the growing interest in sustainable finance and the integration of environmental, social, and governance (ESG) factors into mortgage loan securitization.

- Examine the potential for green mortgage-backed securities, social impact bonds, and other ESG-aligned financial instruments to promote responsible investing and address societal challenges.

Conclusion:

This article illuminates the intricate journey of mortgage loan securitization, highlighting its profound impact on the financial landscape and the ever-evolving management of risk. Through a comprehensive exploration of its origins, development, regulatory responses, and future trends, this article underscores the pivotal role of mortgage-backed securities in shaping contemporary finance.

As we reflect on the evolution of mortgage loan securitization, several key themes emerge. Firstly, the constant interplay between innovation and regulation has been a defining feature of this market. From the pioneering efforts of government-sponsored entities to the emergence of private-label securities and structured finance products, innovation has driven growth but also introduced complexities and risks. Regulatory responses, while aiming to safeguard market stability and investor protection, have faced the challenge of balancing innovation with risk management.

The global financial crises of recent decades have served as wake-up calls, prompting introspection and reform within the mortgage-backed securities market. The subprime mortgage crisis of 2008 laid bare the vulnerabilities inherent in complex securitization structures and underscored the need for enhanced risk assessment and transparency. Subsequent regulatory reforms and market adaptations have sought to address these vulnerabilities and rebuild investor confidence.

The future of mortgage loan securitization will be shaped by ongoing technological advancements, changing investor preferences, and evolving regulatory landscapes. Embracing innovation while remaining vigilant to risks will be essential for navigating the complexities of modern finance. By understanding the evolution of risk in mortgage loan securitization, stakeholders can better position themselves to navigate the challenges and seize the opportunities of tomorrow’s financial markets.

Disclaimer: “This article is for educational & entertainment purposes.”