Residential Mortgage-Backed Securities (RMBS) represent a cornerstone of the modern financial landscape, offering investors exposure to the residential housing market while providing homeowners access to capital. RMBS are financial instruments that bundle together numerous residential mortgages, creating a pool of mortgage loans. These pools are then securitized and sold to investors as bonds. The cash flows generated by the underlying mortgage payments form the basis for the returns on these bonds, making them attractive investments for a wide range of investors, from pension funds to hedge funds.

Residential Mortgage-Backed Securities (RMBS) represent a cornerstone of the modern financial landscape, offering investors exposure to the residential housing market while providing homeowners access to capital. RMBS are financial instruments that bundle together numerous residential mortgages, creating a pool of mortgage loans. These pools are then securitized and sold to investors as bonds. The cash flows generated by the underlying mortgage payments form the basis for the returns on these bonds, making them attractive investments for a wide range of investors, from pension funds to hedge funds.

RMBS offer several advantages to both investors and homeowners. For investors, they provide diversification and the potential for steady income streams, often with relatively low levels of risk compared to other investments. Meanwhile, homeowners benefit from the availability of mortgage credit, as lenders are incentivized to originate new loans in order to create more RMBS.

However, the complexity of RMBS can also pose risks, as demonstrated during the global financial crisis of 2008. Understanding the intricacies of RMBS, including the underlying credit quality of the mortgages, the structure of the securitization, and the potential for prepayment and default, is crucial for investors looking to navigate this market successfully. This introduction aims to provide a foundational understanding of RMBS, exploring their structure, benefits, risks, and role within the broader financial system.

A Comprehensive Overview of the Process and Players Involved in RMBS Implementation

Residential Mortgage-Backed Securities (RMBS) implementation involves a series of intricate steps, from the initial pooling of mortgage loans to the issuance of bonds to investors. This process plays a crucial role in the functioning of the housing finance market, providing liquidity to lenders and enabling investors to participate in the residential mortgage market. This comprehensive overview will delve into the various stages of RMBS implementation, highlighting the key players involved and the mechanisms that drive the process.

- Origination of Mortgage Loans:The RMBS implementation process begins with the origination of mortgage loans by lenders such as banks, mortgage companies, or credit unions. These loans are typically extended to homebuyers for the purchase of residential properties. Lenders assess the creditworthiness of borrowers, evaluate property values, and determine the terms of the loans, including interest rates and repayment schedules.

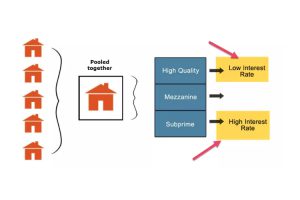

- Pooling of Mortgage Loans:Once a sufficient number of mortgage loans have been originated, they are pooled together to form a mortgage-backed security. The pooling process involves bundling similar types of mortgages, such as fixed-rate or adjustable-rate loans, and grouping them into homogeneous pools. This diversification helps mitigate risk by spreading exposure across multiple loans and borrowers.

- Securitization Structure:The pooled mortgage loans are then transferred to a special purpose vehicle (SPV), a separate legal entity created solely for the purpose of issuing RMBS. The SPV structures the securitization, dividing the pool of mortgages into different tranches with varying levels of risk and return. These tranches are designed to appeal to different types of investors, ranging from conservative investors seeking stable income to risk-tolerant investors pursuing higher yields.

- Credit Enhancement:To enhance the credit quality of RMBS and attract investors, credit enhancement mechanisms may be employed. This can include overcollateralization, where the value of the underlying mortgage pool exceeds the value of the issued securities, as well as the use of reserve funds or insurance policies to cover potential losses.

- Bond Issuance:With the securitization structure in place and credit enhancement mechanisms implemented, the SPV issues RMBS to investors in the form of bonds. These bonds represent claims on the cash flows generated by the underlying mortgage payments. The bonds may have different characteristics, such as maturity dates, coupon rates, and payment priorities, depending on the tranche they belong to.

- Servicing of Mortgage Loans:While the SPV holds the legal title to the mortgage loans, servicing rights are typically retained by the original lenders or transferred to third-party servicers. These servicers are responsible for collecting mortgage payments from borrowers, distributing payments to investors, and managing delinquencies and defaults.

- Investor Participation and Trading:Once issued, RMBS bonds are traded in the secondary market, allowing investors to buy and sell them based on market conditions and investor preferences. The secondary market provides liquidity to investors and enables price discovery, reflecting changes in interest rates, credit quality, and other factors.

Benefits of Residential mortgage-backed securities (RMBS)

Residential Mortgage-Backed Securities (RMBS) offer several benefits to various stakeholders in the financial ecosystem. Firstly, RMBS provide liquidity to lenders by enabling them to transfer mortgage loans off their balance sheets, freeing up capital for additional lending. For investors, RMBS offer diversification and the potential for steady income streams, often with relatively low levels of risk compared to other investments.

Additionally, RMBS allow investors to gain exposure to the residential housing market without directly owning physical properties, offering a more accessible entry point into real estate investment. Moreover, RMBS contribute to the availability of mortgage credit for homeowners by incentivizing lenders to originate new loans. By securitizing mortgages, RMBS facilitate the flow of capital from investors to borrowers, helping to support homeownership and promote economic growth. Overall, RMBS play a crucial role in the functioning of the housing finance market, providing benefits to lenders, investors, and homeowners alike.

Conclusion

In conclusion, Residential Mortgage-Backed Securities (RMBS) serve as a vital component of the financial landscape, offering liquidity to lenders, diversification to investors, and access to mortgage credit for homeowners. Despite the complexities and risks associated with RMBS, their role in facilitating the flow of capital in the housing finance market cannot be overstated. By pooling mortgage loans and issuing securities backed by these assets, RMBS contribute to the stability and efficiency of the housing market while providing opportunities for investment and homeownership. Understanding the benefits and challenges of RMBS is essential for navigating this dynamic segment of the financial markets.

Disclaimer: “This article is for educational & entertainment purposes.”