In today’s dynamic financial landscape, the practice of loan-level securitization stands as a pivotal mechanism for managing risk and optimizing capital allocation. This introductory analysis delves into the intricate world of loan-level securitization, exploring its fundamental concepts, methodologies, and significance in contemporary markets.

In today’s dynamic financial landscape, the practice of loan-level securitization stands as a pivotal mechanism for managing risk and optimizing capital allocation. This introductory analysis delves into the intricate world of loan-level securitization, exploring its fundamental concepts, methodologies, and significance in contemporary markets.

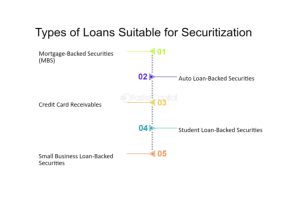

Loan-level securitization involves the bundling of individual loans, such as mortgages or auto loans, into a pool that serves as collateral for the issuance of securities. These securities, backed by the cash flows generated from the underlying loans, are then sold to investors seeking exposure to diversified asset classes.

The allure of loan-level securitization lies in its ability to transform illiquid assets into tradable securities, thereby enhancing liquidity in financial markets. Furthermore, by redistributing credit risk among a broad spectrum of investors, this process fosters greater efficiency and stability in the allocation of capital.

However, the complexity of loan-level securitization demands rigorous analysis to navigate its inherent risks and potential rewards effectively. Factors such as credit quality, prepayment risk, and market conditions exert profound influences on the performance of securitized assets, necessitating robust analytical frameworks and risk management strategies.

In this context, this analysis aims to provide a comprehensive overview of loan-level securitization, offering insights into its mechanics, valuation methodologies, and risk assessment techniques. By illuminating the intricacies of this financial practice, stakeholders can make informed decisions and harness the benefits of loan-level securitization in their investment endeavors.

Delving into Loan-Level Securitization Mechanics

Understanding the mechanics of loan-level securitization is essential for grasping its intricacies and potential impacts. This section will delve into the step-by-step process involved in transforming individual loans into tradable securities.

- Loan Pool Formation:

The first stage in loan-level securitization involves the aggregation of individual loans into a pool. These loans typically share similar characteristics, such as credit quality, maturity, and geographic location. Pool formation aims to create a diversified portfolio that mitigates specific risks associated with individual loans.

- Structuring the Securitization Vehicle:

Once the loan pool is formed, a securitization vehicle, often in the form of a special purpose vehicle (SPV), is established to hold the pooled assets. The SPV serves as a legal entity separate from the originator, ensuring the isolation of securitized assets from the originator’s balance sheet.

- Asset Backing and Tranching:

The pooled loans serve as collateral for the issuance of securities, which are divided into tranches with varying levels of risk and return. Senior tranches, backed by the most creditworthy loans, offer lower yields but greater security, while subordinate tranches, backed by riskier loans, provide higher potential returns but entail increased risk of default.

- Credit Enhancement:

To enhance the credit quality of securitized assets and attract investors, various forms of credit enhancement may be employed. These include overcollateralization, cash reserves, and financial guarantees from third-party entities. Credit enhancement mechanisms serve to absorb potential losses and protect investors from adverse events.

- Issuance and Sale of Securities:

Once the securitization structure is in place, securities backed by the loan pool are issued and sold to investors in the capital markets. The proceeds from the sale of securities are used to repay the originator for the underlying loans, thus completing the securitization process.

Analyzing Risks and Returns:

A thorough analysis of risks and returns is crucial for evaluating the viability and attractiveness of loan-level securitization investments.

- Credit Risk Assessment:

Assessing the credit risk associated with securitized assets involves analyzing the creditworthiness of underlying borrowers, as well as the structural features of the securitization transaction. Factors such as default probability, loss severity, and recovery rates influence the credit risk profile of securitized assets.

- Prepayment Risk Management:

Prepayment risk, the risk that borrowers will repay their loans earlier than expected, can impact the cash flows and returns of securitized assets. Effective prepayment risk management strategies involve modeling prepayment behavior, monitoring market conditions, and implementing hedging techniques to mitigate adverse effects.

- Market Risk Considerations:

Market risk, stemming from fluctuations in interest rates, credit spreads, and other market variables, can affect the value and performance of securitized assets. Assessing market risk involves conducting sensitivity analyses, stress testing, and scenario planning to gauge the potential impact of adverse market conditions.

Optimizing Performance through Advanced Analytics

Once the mechanics and risk factors of loan-level securitization are understood, the next step involves leveraging advanced analytics to optimize performance and enhance decision-making processes.

- Data Analytics and Modeling:

Utilizing robust data analytics and modeling techniques is essential for gaining insights into the performance of securitized assets. By analyzing historical loan-level data and employing predictive modeling algorithms, stakeholders can forecast cash flows, evaluate default probabilities, and assess the impact of various risk factors on asset performance.

- Scenario Analysis and Stress Testing:

Conducting scenario analysis and stress testing allows stakeholders to assess the resilience of securitized assets under adverse market conditions. By simulating various economic scenarios and stress scenarios, stakeholders can identify vulnerabilities, quantify potential losses, and develop contingency plans to mitigate risks effectively.

- Optimization Strategies:

Implementing optimization strategies, such as portfolio rebalancing, asset allocation adjustments, and hedging techniques, can enhance the risk-return profile of securitized asset portfolios. By dynamically managing portfolio composition and risk exposures, stakeholders can maximize returns while minimizing downside risks.

- Regulatory Compliance and Reporting:

Ensuring regulatory compliance and robust reporting practices is paramount in the realm of loan-level securitization. By adhering to regulatory guidelines, disclosing relevant information, and maintaining transparency in reporting, stakeholders can build trust with investors, regulators, and other market participants, thereby fostering confidence in securitized asset markets.

Incorporating advanced analytics into the decision-making process enables stakeholders to adapt to evolving market conditions, identify opportunities, and mitigate risks effectively. By leveraging data-driven insights and optimization strategies, stakeholders can unlock the full potential of loan-level securitization and achieve superior performance in their investment endeavors.

Conclusion

In Conclusion, delving into the mechanics and risk factors of loan-level securitization is essential for investors, financial institutions, and policymakers seeking to navigate the complexities of modern financial markets. By understanding the intricacies of loan-level securitization and implementing robust risk management practices, stakeholders can harness the benefits of this financial innovation while effectively managing associated risks.

Disclaimer: “This article is for educational & entertainment purposes.”